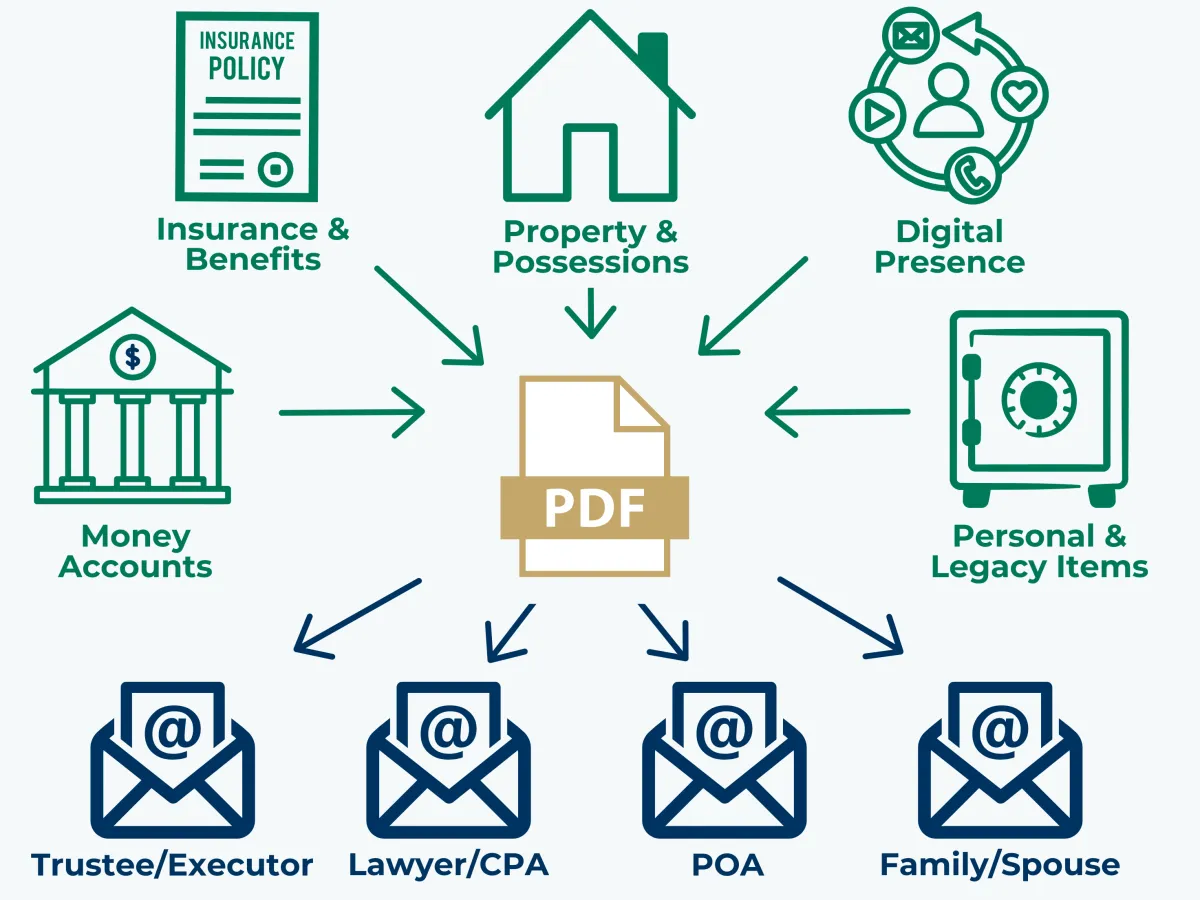

The Legacy Asset Locator is a guided system that creates a clear, usable map of every asset, account or policy you own — physical and digital — without collecting any personal or financial credentials.

It documents what exists, then securely distributes that information to the people you've appointed (executor, trustee, power of attorney), so action can be taken when it matters - leaving them with zero guesswork.

The Legacy Asset Locator ensures the right people have the right information they need to act at the right time - during incapacitation or after death.

Here's How It Works

1. Guided Intake Setup (30–60 minutes)

Answer simple guided questions across six logical categories to comprehensively list what you own, where it lives.

Most people start with the Lite Intake and return later to complete the full version over time.

2. Smart Structuring

These categorized answers are formatted into an easy-to-read, secure, non-sensitive “Legacy Asset Locator.” PDF

3. Quarterly Nudges

You’ll receive email prompts to update anything that’s changed. Updates take five minutes and keeps your asset list living, not forgotten.

4. Secure Distribution

The read-only PDF is shared (per your rules) with your executor, lawyer, CPA, POA, or trusted contact(s) - version-controlled and time-stamped.

Your asset locator simply updates with your life.

(No payment required today)

🛡️Security & Privacy Standards

Security you can trust.

User-controlled sharing - you choose who receives your Locator and when

We NEVER collect or store:

Login credentials

Financial credentials

Identity credentials

Legal or medical documents

Anything that enables access or action

The Legacy Asset Locator can NEVER be used to access money, take over accounts, or impersonate you - because it never stores personal or financial credentials.

Security and Privacy by design.

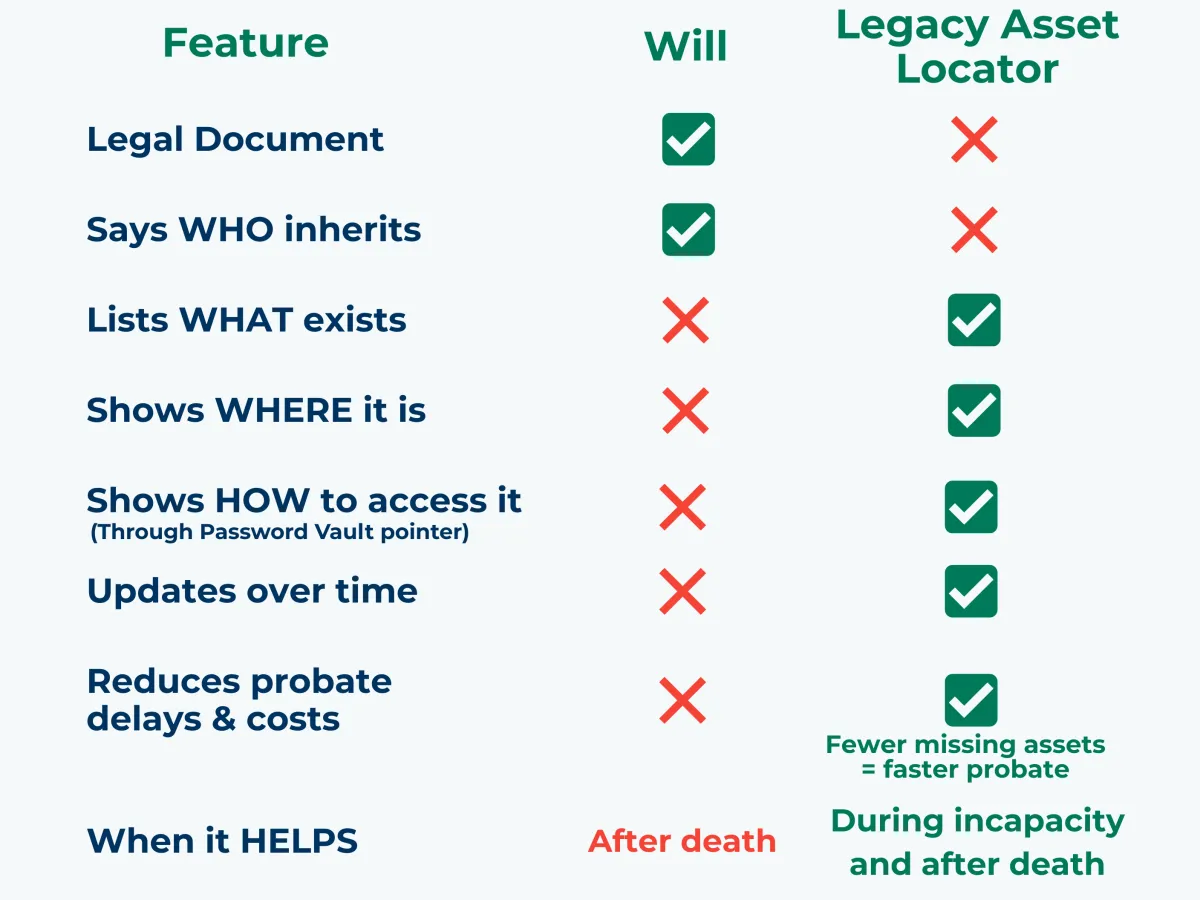

Will Vs Legacy Asset Locator

A Will Defines Intent. The Legacy Asset Locator Enables Action.

Accounts, Policies, Wallets, Domains, and Documents live in 20 different places.

Scraps of paper, folders under beds, multiple apps, inboxes, and files - all under different logins, buried in different systems.

If you don't create a centralized record:

Policies get missed. Fees keep charging. Assets get lost.

Every year, millions in “unclaimed” money piles up

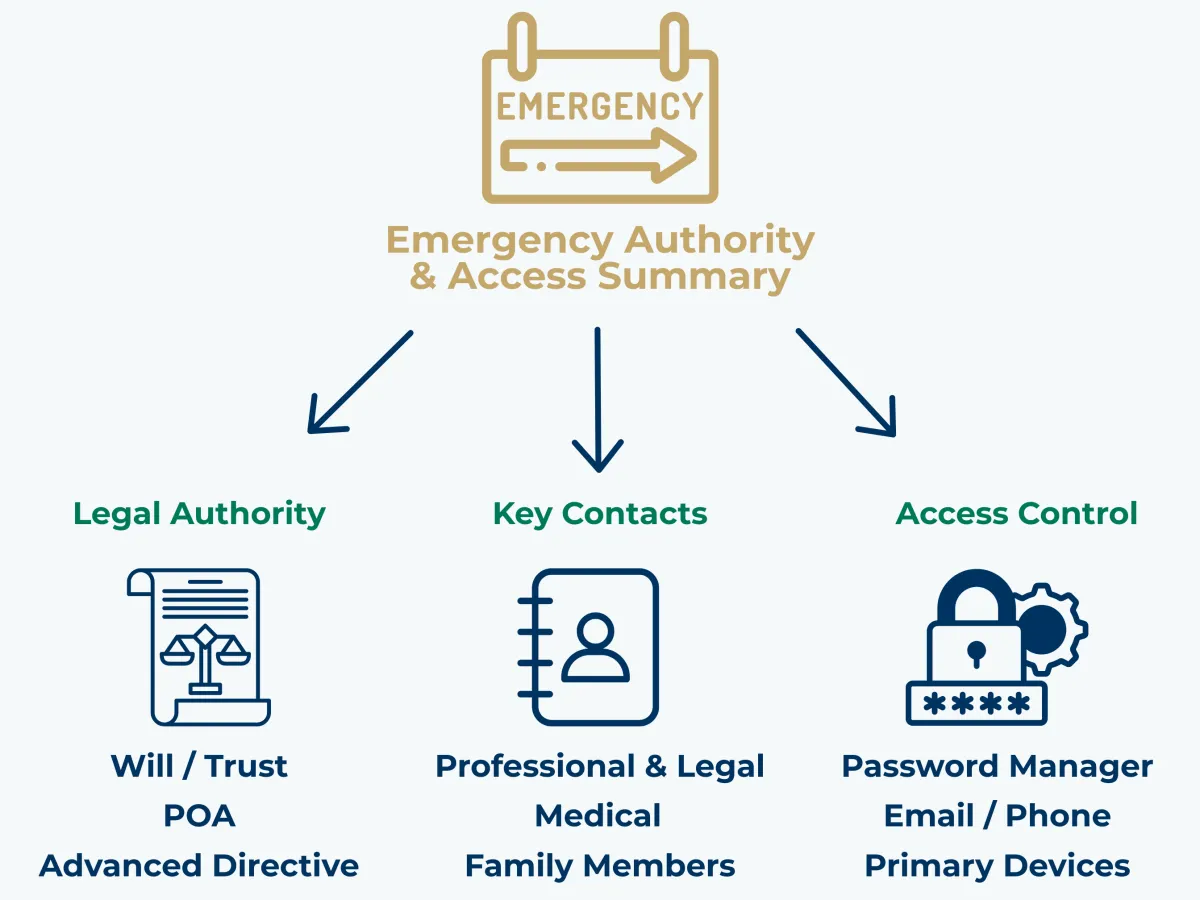

The First Page Someone Would Open in an Emergency

Before listing assets, the Legacy Asset Locator creates an Emergency Authority & Access Summary that can be used during incapacity AND after death

The Legacy Asset Locator gives anyone you authorize a clear, current map of what exists and where to look.

What Executors and POAs Are Expected to Find — But Usually Can’t

Most people focus on the obvious assets and miss dozens of smaller ones that still require action.

1. Authority & Access

What authority acts on you life and how it is accessed.

Legal Authority

Key Contacts

Access Control

2. Money Accounts

Everything that moves money in or out of your life.

Banks & savings accounts

Brokerage & investment accounts

Retirement funds (401k/IRA)

PayPal, Venmo, Cash App balances

Crypto wallets and exchanges

3. Insurance & Benefits

lost assets if your family doesn't know about them.

Life & disability insurance

Employer benefits

Pensions & survivors’ benefits

Annuities

HSA/medical reimbursements

4. Property & Possessions

The physical world you leave behind.

Real estate & deeds

Vehicles & titles

Safe deposit boxes

Valuable items

Storage units

5. Digital Presence

Accounts you use and recurring payments

Email, cloud storage, photo libraries

Social accounts & digital legacy settings

Subscriptions, memberships, apps, VPNs

Domain names, website hosting

Rewards: points, miles, credits

6. Personal & Legacy Items

The important things only you know about.

Personal wishes & instructions

Household “how-to” (accs, services, maintenance.)

Sentimental items to pass down

This is not a balance sheet. It’s an action map.

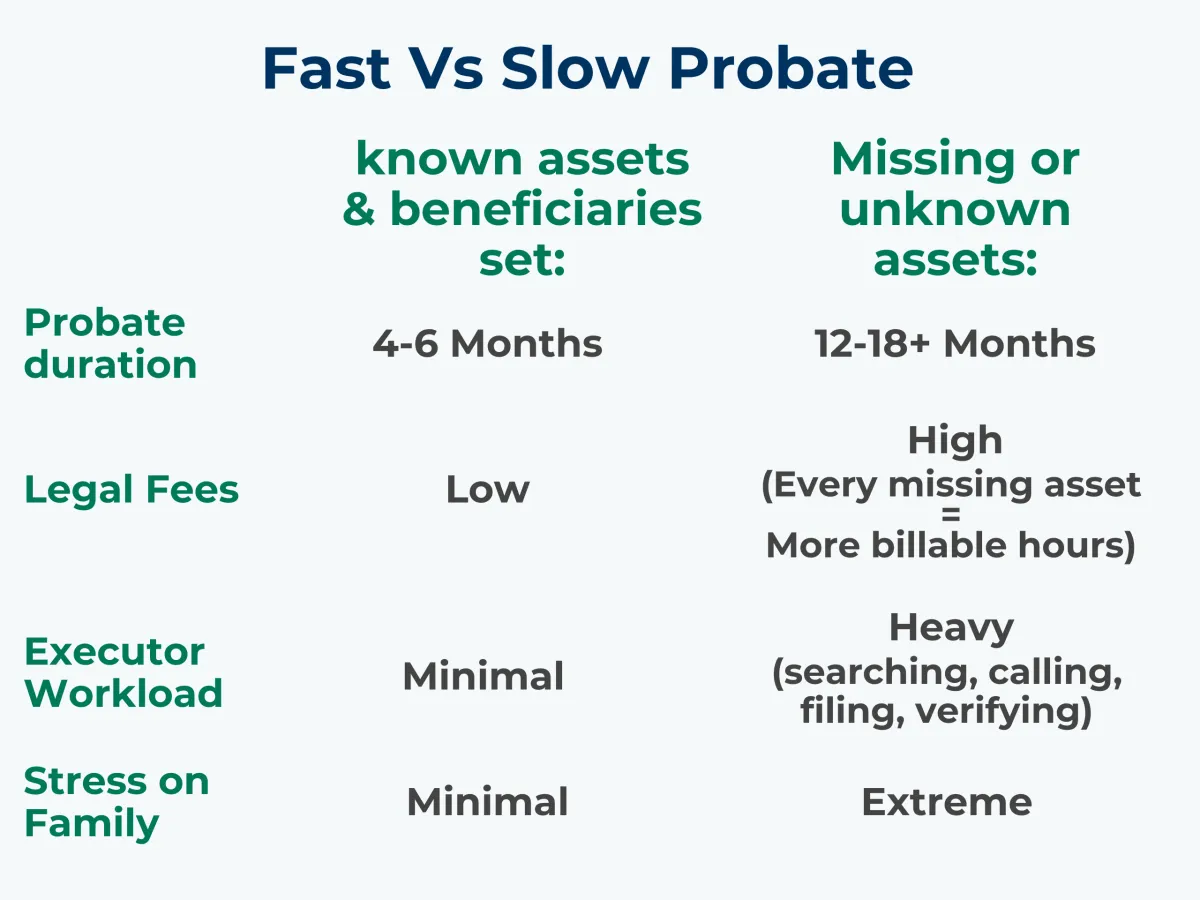

Why The Scavenger Hunt Makes Probate Slow, Stressful, and Expensive

Probate courts don’t tell you what exists - your executor has to find out.

And here’s what almost no one realises: Assets with a named beneficiary skip probate entirely - saving months of delays and thousands in fees.

The Legacy Asset Locator helps you by prompting if you have beneficiaries designated: If you're unsure or don't know, it creates a 'To Do List' for you so you can address the unknowns.

You can’t avoid probate - but you can avoid expensive probate.

Organisation today = massive time and money saved for your family later.

Simple, Transparent Pricing

The Legacy Asset Locator is designed to stay current — because life changes.

Your first year is $39, which covers guided setup, unlimited updates, secure distribution and gentle quarterly reminders as life evoles - helping you get everything mapped properly from the start.

After the first year, the cost is $20 per year to keep everything up to date and securely distributed — with unlimited updates always included.

There are no hidden fees, no lock-in, and you can cancel at any time. You’re always in control.

(No payment required today)

Don't add to the statistics because you didn't take action in the living years:

40% of spouses DON'T know about all existing assets.

Most families don’t have a system - just one person who knows where everything is.

In 2025 Forgotten retirement accounts now exceed $2.1 trillion.

Only 32% of Americans have a plan to inform loved ones of assets.

Fewer than one in six plans include digital assets.

(social accounts, domains, crypto)

One in seven Americans have some sort of unclaimed asset.

Outcome

“Nothing lives only in my head anymore.”

Setup is simple and fast.

Updates in minutes.

Your executor and POA have the map.

Your lawyer and CPA knows where everything is.

Your family has one less thing to worry about when the time comes.

Emotional relief knowing everything is documented

Features & Benefits

Minimal data entry

Fast initial data entry via chatbot. Keep secrets in your password manager; we just point to them.

Quarterly nudges

5-minute reviews keep it current.

Version controlled

See what changed and when.

Secure distribution

Right info, right person, right time.

Covers the real world

Bank/broker/crypto, insurance/pensions, property, subscriptions, domains, cloud, socials, documents

Common Questions People Ask Before Starting:

“Isn’t this what a will or trust is for?”

A will says who inherits. A trust says what passes. Neither lists what exists or where it lives.

“Do I have to gather everything first?”

No. The system prompts you and helps you discover gaps as you go.

“Is this secure?”

No personal or financial credentials. The Legacy Asset Locator is a map — not a vault.

What You Get Today

Join the waitlist to lock in early access and receive the Starter Kit —

a practical guide to reducing unknowns before the full system launches.

Lock in early-adopter pricing:

$39 at launch + $20/annually thereafter. Your rate is locked; you won’t be charged now.

Starter Kit:

A structured Starter Kit that helps you:

Understand what your executor or POA would actually need to act

Secure access before anything else

Take a few quick steps that prevent real problems

Identify hidden assets that cause delays and unnecessary costs

Understand how everything comes together with the Legacy Asset Locator

This Starter Kit is not a full inventory — it’s the foundation that makes one possible.

(No payment required)

Trust & Safety

Zero personal or financial information collected

Read-Only PDF Output

User-Controlled Sharing

About the Founder

Hi, I’m Steve - the person behind Done Once Lab.

For more than 20 years, I worked in the defense sector, where attention to detail wasn’t optional. Everything had to be planned, documented, and organized across teams and systems. That mindset shaped how I run my own life.

But even with my own digital vault, clear folders, and personal workflows, I had a moment that stopped me cold:

If I dropped dead tomorrow… would my wife actually know where everything is?

The bank & investment accounts?

The insurance policies?

The cloud storage?

The subscriptions?

The digital accounts?

The random places we have money?

I realized, sadly, the answer was probably not.

Not because she isn’t capable - but because modern life is scattered across dozens of apps, inboxes, and accounts. We're not unique - most families are in the exact same position.

That felt awkward to me.

I care about people.

I care about not leaving a mess behind.

If we know we can do better for the people we love, we should.

That’s why I built the Legacy Asset Locator - a simple, guided way to capture the things your executor or POA will desperately need, but would have no easy way to find. No passwords. No sensitive data. Just clarity.

Not everyone has a detail-oriented person in the family.

So I built the tool I wished already existed - to help every family close the loop with less stress, fewer delays, and far more peace of mind.

Do it once. Set it up right. Never worry about it again.

That’s the mission behind Done Once Lab.

FAQs

Your Questions, Answered - Because Peace of Mind Should Be Simple.

Is this a will?

No.

It’s the companion to your will: a living index that helps your people find your assets fast after you're gone.

Do you store passwords or bank logins?

No.

The Legacy Asset Locator never stores passwords, login credentials, banking details, identity numbers, or legal/medical documents.

It’s designed to provide clarity and direction — not access.

How long will setup take at launch?

Most people can do a first pass in 30–45 minutes, then quick quarterly check-ins.

Is this only useful after I die?

No.

It’s just as valuable if you’re incapacitated.

If you’re injured, ill, or unable to manage things temporarily, your Power of Attorney may need to step in immediately.

The Legacy Asset Locator gives them a clear, current map of what exists and where to look - without guessing.

Who should receive the Legacy Asset Locator?

Anyone you authorize.

Common recipients include your executor/trustee, lawyer, CPA, Power of Attorney, or spouse. You control who receives it. It’s shared read-only, with no sensitive data.

Is this a one-time purchase or a subscription?

The Legacy Asset Locator is a subscription-based service, because it’s designed to stay current as your life changes.

Your first year is $39 and includes guided setup, unlimited updates, secure distribution, and quarterly reminders. After that, it’s $20 per year to keep everything up to date.

You can cancel at any time, and you’ll always be notified before anything is charged.

Why does it need to be ongoing at all?

Because information that isn’t maintained quietly becomes outdated.

Accounts change. Assets get added or closed. Roles shift. New devices appear.

The value of the Legacy Asset Locator comes from keeping the right people informed over time, not from a one-time snapshot.

What happens if I cancel?

If you cancel, no future reminders are sent, no further distributions are made, and no additional charges are incurred.

You remain in control of your information at all times, and nothing is shared or updated without your action.

What format is the Asset Locator generated in?

Read only PDF with version history.

Why should I care about having a Legacy Asset Locator?

Wills don’t tell people where everything is or how to gain access. Trusts don't do this either. This will be the responsibility of your executor or trusted person to piece all of this together - don't put this burden on someone you love.

What if I change my mind later

You can edit or delete your locator anytime; you’re in control. If you distributed you Legacy Asset Locator once, you're 99% ahead of most people!

I already have a will/trust and beneficiaries - do I still need this?

Yes — because legal documents don’t list what exists or where it lives.

Trusts, wills, and beneficiary forms decide who gets assets. The Legacy Asset Locator helps the people handling your affairs actually find them — especially accounts, subscriptions, digital assets, and forgotten items.

Who is this actually for?

The Legacy Asset Locator is designed for people who:

- Have named an executor, trustee, or power of attorney

- Manage accounts, assets, or digital life across multiple places

- Want to reduce confusion during incapacity or after death

It’s especially useful for busy professionals, parents, and anyone who wants to leave clarity instead of guesswork.

Is this only relevant in the U.S.?

No.

While account types and terminology vary by country, the underlying problem is the same everywhere: the people you trust don’t know what exists or where to look.

The Legacy Asset Locator focuses on visibility and responsibility, not country-specific account structures.

Is this a legal document?

No.

The Legacy Asset Locator is not a legal document and does not replace a will, trust, or power of attorney.

It’s designed to work alongside those documents by making them usable in real life.

Still Have Questions

If you have questions that aren't answered above, please feel free to reach out to us at the email address below.